Central Bank Gold Holdings

DEMAND to buy gold among central banks is a key part of the bullion market.

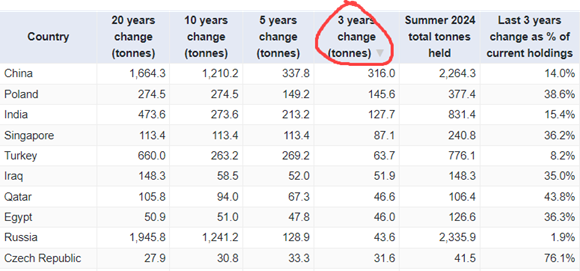

Which countries are buying the most gold for their reserves?

Why do central banks buy and hold so much gold?

Who is buying the most gold among central banks and why?

#3. India

#2. China

#1. Russia

What about the top 4 gold-owning central banks?