ChatGPT Makes Copper the New Oil

10x the electricity use of a Google search...

DID you know that every time you type a query into ChatGPT, it requires about 10 times as much electricity to process as a Google search? asks Frank Holmes at US Global Investors.

That's according to Goldman Sachs, which writes in a new report that electricity consumption in the US is poised for a major surge for the first time in years, due in large part to the rapid buildout of data centers that power AI platforms such as ChatGPT.

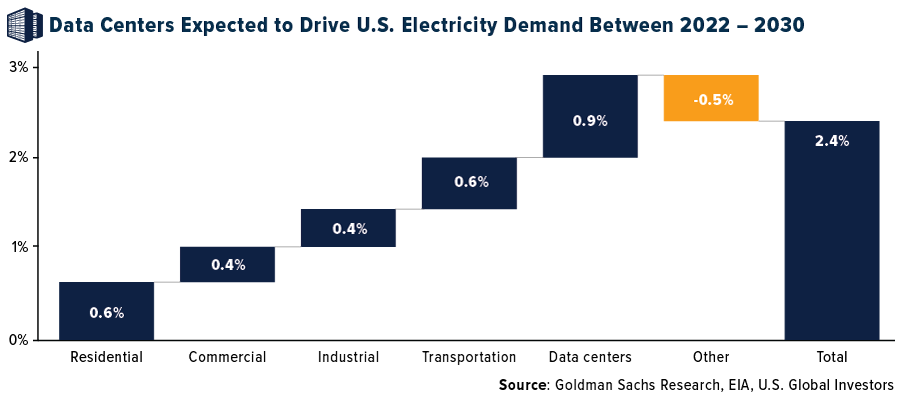

Goldman says it's projecting electricity demand to rise approximately 2.4% from 2022 to 2030, with data centers representing the largest growth segment at 0.9 percentage points – nearly a third of total new demand.

Goldman isn't the only firm that's forecasting huge changes to the US energy grid.

The Electric Power Research Institute (EPRI), a Washington, DC-based nonprofit, estimates that data centers could consume up to 9% of US electricity generation by 2030, more than double their current consumption.

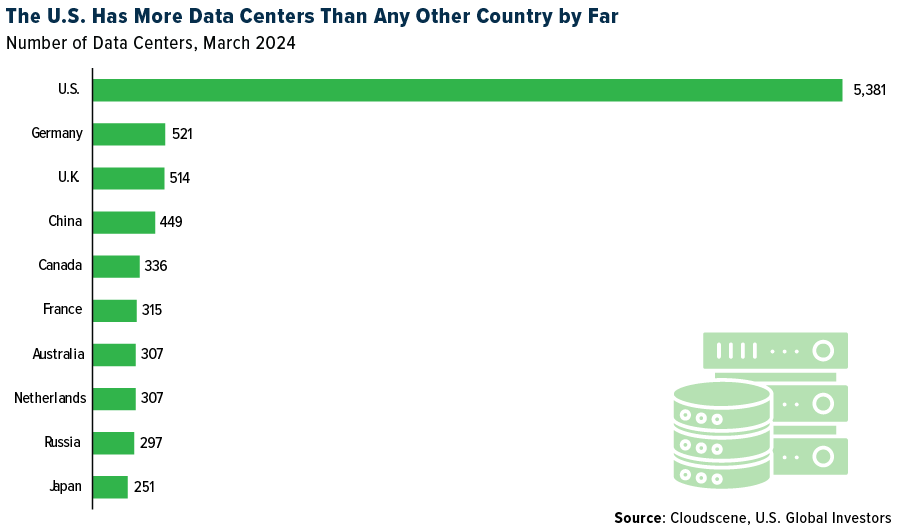

To help put things in perspective, ChatGPT currently has over 180 million users, but there are around 5.3 billion internet users around the world. Imagine if each of them became a regular user of energy-intensive ChatGPT, whose servers are located in the US, according to owner OpenAI.

The US is currently home to nearly 5,400 data centers, the most of any other nation by far. Even so, additional capacity will need to come online to meet runaway demand, and giant tech companies – from OpenAI and Microsoft to Google, Meta, Amazon and more – are spending billions to position themselves as leaders in the nascent industry.

So how will this biblical amount of electricity be generated? According to a separate Goldman report, natural gas is expected to supply 60% of the growth from AI and data centers, with renewables providing the remaining 40%.

The resurgence in natural gas demand is already being felt, with analysts at Wood Mackenzie now expecting total US gas demand to increase by 30 billion cubic feet per day (bcfd) by the early 2040s, a substantial increase from previous estimates. This spike is due to the AI boom and the corresponding rise in data center activity.

For investors, this presents a unique opportunity. Natural gas prices, which are down more than 32% so far this year due to strong production and lower demand, are expected to rebound. Wells Fargo projects that prices could average $3.50 per thousand cubic feet by 2030, a 46% increase over the 2024 average price of $2.39. This potential for price appreciation, I believe, makes natural gas an attractive investment.

While natural gas will be a key player in meeting future power needs, copper is equally essential, particularly for its role in the energy transition. Copper is the only critical mineral present in AI as well as all of the most important clean energy technologies, including electric vehicles (EVs), solar photovoltaics (PV) and wind power. Its combination of conductivity, longevity, ductility and corrosion resistance makes it an indispensable mineral.

However, the supply side of the copper market is fraught with challenges. To meet current trends, an astounding 115% more copper must be mined in the next 30 years than has been mined in human history. The International Energy Forum (IEF) warns that under current policy settings, it's unlikely there will be sufficient new mines to achieve 100% EV adoption by 2035. This is compounded by declining ore quality, which leads to increasing capital and operating costs.

Ready or not, demand for the red metal continues to soar. Year-to-date, copper prices are up nearly 25% and recently hit an all-time high of over $11,000 per ton. This price surge is driven by long-term demand forecasts and supply constraints, making copper a highly attractive commodity.

The anticipated rise in US power demand, driven by AI, EVs and the energy transition, will undoubtedly impact the markets. As I see it, natural gas and copper stand out as assets I might want to have exposure to going forward.

Natural gas offers a stable and growing demand outlook, with prices poised to recover from recent lows. Investing in natural gas companies or ETFs that focus on this sector could provide significant returns as the demand for power grows.

Similarly, copper's essential role in the energy transition makes it a critical investment. I don't believe anyone can deny its long-term demand viability. Investors should consider exposure to copper through mining companies, ETFs or even futures contracts to capitalize on this trend.

Email us

Email us