Market Highs? All About the Pivot

Fed hiked rates, yet policy loosened...

The FEDERAL RESERVE began kinking its monetary hose two years back, writes Brian Maher in The Daily Reckoning.

This it did through fevered interest rate elevations and quantitative tightening.

Yet the stock market put out its tongue, placed its thumbs in its ears and wiggled its fingers in Mr.Powell's face.

It has gone streaking to record heights – despite the Federal Reserve's kinks.

A conundrum! Or is it?

We are informed that financial conditions are presently extravagant.

They are among the loosest in several decades. Simon White of Bloomberg:

"Monetary policy remains exceptionally loose given one of the fastest rate-hiking cycles seen....policy overall remains very loose despite over 500 basis points of rate hikes....

"Standing back and looking at the totality of monetary policy in this cycle, we can see that – far from conditions tightening – we have instead seen one of the biggest loosenings of them in decades."

Is it evidence you seek? Then it is evidence you shall have:

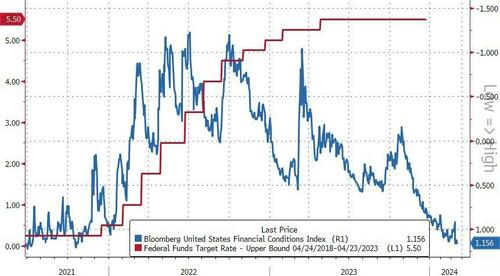

The steeply ascending red represents the Federal Reserve's target rate.

The largely descending blue represents financial conditions as Bloomberg gauges them.

The Federal Reserve has undertaken four rate elevation cycles within the past 30 years.

None has yielded a greater financial loosening than the present cycle.

How do you explain it?

Here Joe Weisenthal and Tracy Alloway – they of the Odd Lots newsletter – hazard an attempt:

"It certainly feels like there's a pattern where the mere whisper of rate cuts sparks easier financial conditions (as markets rally), while hawkish moves seem to do hardly anything....

"As Viktor Shvets over at Macquarie put it this week: 'Any hint of the Fed considering an even minor pivot significantly eases financial conditions while a more hawkish tone only barely tightens'."

We believe there is justice here.

Further disentangling this perplexing knot – perhaps – is a certain Stephane Renevier.

"Interest rates aren't the be-all and end-all of financial conditions. Yes, higher rates generally mean pricier loans – but there are a whole lot of other factors that affect how easy or tough it is for firms and everyday folks to get financing and keep the economic show on the road.

"Think about the cost for companies to borrow (credit spreads), how well the stock market is doing (that's another source of financing) and how strong the Dollar is (a weaker Dollar means cheaper loans for people around the world who take on debt in greenbacks, pumping more cash into the global economy).

"Since the end of last year, all those factors have turned more positive and have offset the US' towering interest rates, making financial conditions looser, not tighter."

The stock market ebbs and flows with shifting financial conditions....as the tide ebbs and flows with the moon's shifting humors.

Is it a wonder – then – that the stock market has ebbed with the ebbing financial tide?

We hazard it is no wonder whatsoever.

For financial conditions are as loose and lax as a harlot's virtue – if not looser and laxer.

Yet the Federal Reserve believes it has guarded its own virtue with fantastic ferocity.

It believes its anti-inflationary whim-whams have choked financial conditions nearly to death. Mr.Powell at the FOMC press conference:

"We think financial conditions are weighing on the economy."

Has this fellow trained his eyes upon the figures?

We must conclude he has not. Or – or – he is aware of them and intends to depress rates regardless.

For what purpose....we are reduced to speculation. We do not know.

This we do know:

Wall Street heavily expects the Federal Reserve to soon execute its cherished pivot – perhaps in June.

And we believe Wall Street is correct. The Federal Reserve will soon commence its rate-depressing campaign.

And so a question rises into air:

If financial conditions are lenient while rates have taken an extended hike....how much more lenient will they be once the Federal Reserve depresses rates?

Will they rocket the stock market to truly cosmic heights? Will they kindle inflation's flames?

The above-cited Renevier:

"Since easier financial conditions are like steroids for the economy, and inflation is a result of stronger economic growth, it makes sense that investors are expecting inflation to rise again.

"Now, that does go against what the Federal Reserve says it's trying to achieve – ie, keeping inflation around its 2% target. And if the central bank does cut interest rates three times this year, as it suggested just this week, that could lead to even cushier financial conditions – and further stoke the risk of an inflation comeback."

We contest the claim that inflation is the consequence of economic growth. We nonetheless permit the case to proceed....

"These policymakers are betting that inflation will dial down as the job market cools, and are probably expecting those other factors (credit spreads, the stocks' rally and Dollar weakness) to mellow out too – all of which could take some heat off inflation. But at the same time, they're also placing a wager on stronger economic growth. It's a razor-thin line they're trying to walk.

"And in the meantime, we're in a weird spot: economic growth picking up, inflation flirting with a comeback and financial conditions easing way more than you'd expect, given where interest rates are. That mixed vibe is why oil and copper prices are on a tear (they both like strong growth and a whiff of inflation), why gold and Bitcoin are hitting it big (they're the cool kids when financial conditions loosen and inflation flexes) and why stocks are smashing it against all odds (they thrive on robust growth and easy money conditions, and aren't overly bothered by inflation).

"We might not be in this peculiar position for long: Inflation could turn the heat way up, and put financial conditions into a deep freeze, and all of that could put a damper on growth.

"But for now, the party's on."

What will Powell and mates do then?

Yet then is then and now is now.

Indeed....for now....the party is on, because the Federal Reserve is this party's host.

We do not trust its management of the liquor that sustains it. We hazard the attendees....presently thrilling to alcoholic excitements....are in for one royal hangover.

Email us

Email us