Election 2024: All Roads Lead to Inflation

So buy gold and silver, right...?

WITH ONLY one week remaining before the US presidential election, there's a growing sense of uncertainty in the air, writes Frank Holmes at US Global Investors.

Investors are wondering how to position their money, bracing for the possibility of significant volatility and market shifts.

While some hedge funds are making bold moves on so-called "Trump trades", we at US Global Investors see things differently.

In fact, I share billionaire hedge fund manager Paul Tudor Jones' recent outlook on gold and Bitcoin (which validates what I have been writing about for many years). Like him, we currently favor alternative assets as the smart play going forward.

It's not that we're betting against stocks or the economy, which we believe will do well over time no matter who wins the White House next month. Nevertheless, the writing is clearly on the wall:

Ballooning US debt and geopolitical tensions all point to the need for a strong hedge.

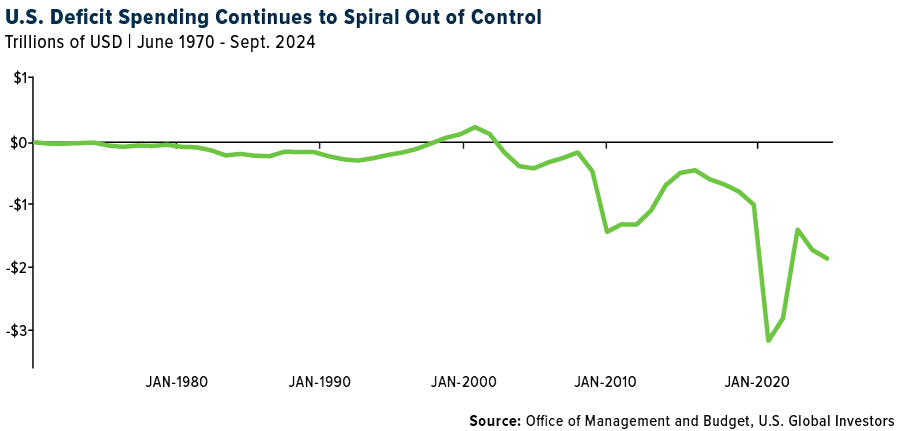

You won't be surprised to read that the US debt situation has spiraled out of control. Just 25 years ago, the national debt was a little under 60% of GDP. Today, that rate has doubled to 120%.

According to Paul Tudor Jones, founder and CEO of Tudor Investment Corp., this puts the US in a precarious position – ne that's unsustainable in the long run unless serious action is taken to rein in government spending.

We all know that politicians have a knack for promising more spending (in the Democrats' case) or tax cuts (in the Republicans' case) to keep voters happy. It's easy to see why Jones is concerned that either approach will only exacerbate the debt problem. As he pointed out, the US is "going to be broke really quick unless we get serious about dealing with our spending issues."

That's not just a dramatic soundbite – it's a reality check. The federal deficit for 2024 soared above $1.8 trillion, up 8% from the previous year. Meanwhile, the debt burden, which is rapidly nearing $36 trillion, shows no signs of easing.

US federal deficit of tax revenue to government spending

When the government keeps printing money to finance its spending, the inevitable result is inflation. And in times of inflation, the purchasing power of traditional assets like bonds erodes.

That's why Jones favors assets that perform well in inflationary environments such as gold, silver, commodities and Bitcoin. I agree wholeheartedly with this assessment.

Think about it: Why would you want to own fixed-income assets when interest rates are being adjusted and are likely to be lower than the inflation rate? Long-dated bonds are particularly vulnerable.

US banks, remember, are still dealing with billions of Dollars in unrealized losses on their fixed-income positions. According to Florida Atlantic University's bank screener, Bank of America's unrealized losses on held-to-maturity investments in the first quarter were a staggering $110 billion, more than any other US institution by far.

The Fed will likely try to "inflate" its way out of this mess, meaning it will keep nominal interest rates lower than inflation to support economic growth. For investors, this means that preserving wealth will require smart positioning in alternative assets.

Jones is already betting against the bond market – "I am clearly not going to own any fixed-income," he told CNBC last week – and I believe many investors would be wise to take a similar approach.

Let's start with gold and silver. Both have been go-to haven assets for centuries, and for good reason. When geopolitical tensions have risen, when inflation has reared its ugly head and/or when there's been uncertainty in the markets, investors have flocked to gold and silver.

This year is no exception. We've seen gold shatter records multiple times in 2024, with prices rising more than 32% year-to-date, the metal's best annual growth since 1979.

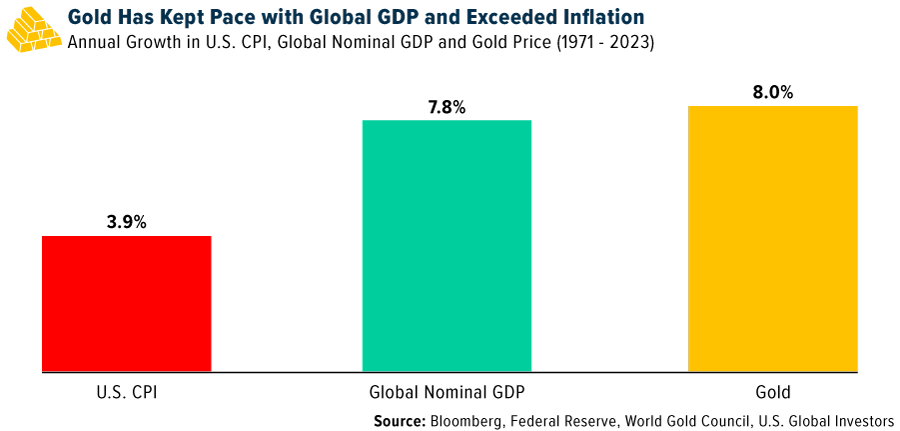

According to data from the World Gold Council, gold has consistently outperformed both inflation and the growth rate of the world economy. From 1971 to 2023, gold's compound annual growth rate (CAGR) was 8%, compared to 4% for the US consumer price index (CPI) and 7.8% for global GDP growth.

Silver, often dubbed the "poor man's gold," is another asset that deserves attention. With its industrial applications, especially in the green energy sector, silver has strong potential for future growth. According to one projection, the clean energy transition could dramatically increase the demand for silver in photovoltaic (PV) technology, potentially consuming between 85% and a jaw-dropping 98% of current global silver reserves by 2050.

Now, let's talk about Bitcoin. The world's largest digital asset has quickly become a preferred store of value for many investors, especially those looking to hedge against fiat currency depreciation. Nearly half of all traditional hedge funds currently maintain exposure to cryptos, including Bitcoin.

Institutions are also backing Bitcoin with the same enthusiasm. Just look at BlackRock's Bitcoin ETF. It's one of the fastest-growing ETFs in financial history, with assets under management now over $26 billion. That's no small feat.

Bitcoin's decentralized nature, capped supply and growing institutional acceptance make it an attractive asset in times of uncertainty. Like gold, it's a hedge against inflation, but it also offers the potential for significant upside as more investors and institutions recognize its value.

Now, I know you may be wondering: "What about the election? What if Trump wins? What if Harris wins?"

Here's a news flash for you: Over the long run, it may not matter as much as you think. Larry Fink, CEO of BlackRock, made a great point recently when he said that he's "tired of hearing this is the biggest election in your lifetime. The reality is over time, it doesn't matter."

While hedge funds are taking positions in "Trump trades" like private prisons and fossil fuels, we believe that trying to time the market based on election outcomes is a risky game. Yes, the election will cause short-term volatility, but if you're in the right assets – like gold, silver and Bitcoin – I believe you'll be well-positioned to weather the storm.

Email us

Email us