Gold bars come in many different shapes and sizes, but buying your gold within a large bar via BullionVault is cheaper per gram.

All small gold bars, coins and jewellery start out as a 400-ounce (12.4kg) "Good Delivery" gold bar. These wholesale gold bars are held by central banks, and traded by professional bullion dealers in London, the centre of the world's 24-hour gold market.

London “Good Delivery” gold bars are the cheapest form of gold bullion on a per gram basis to purchase and own and they fetch the best price when sold.

You don’t have to buy a whole 400-ounce (12.4kg) gold bar to be able to buy your gold at professional bullion market prices.

Investors can now buy and sell any amount of physical gold, from 1 gram to 10 or more gold bars, at real-time bullion market prices. BullionVault enables users to hold and store their precious metals in the form of large wholesale bars in their choice of 5 international vaults. BullionVault is the cheaper, safer, and easier way to own gold.

Buy Gold Bars

The table below shows live gold prices to buy and sell and latest trades in US dollars, British pounds and Euros in each of Zurich, London, New York, Toronto and Singapore vaults where you can buy your allocated portion of a gold bar. Click below to see the live prices you can deal at and to get started on owning gold.

Alternatively, visit our Live Order Board to buy any quantity of bullion within a gold bar or multiple gold bars.

Live order board. Gold in $ US dollars

You will have to pay a small commission of between 0.05% and 0.5% when you buy and sell, and gold storage fees start at $4 down to 0.01% per month. Use our cost calculator to show estimated costs for the amount of gold you want to buy.

Start buying your gold bars today

Buying gold bullion bars produced by London Bullion Market Association (LBMA) approved refiners and stored in similarly accredited vaults guarantees that each gold bar has been accurately assayed for purity and has an unbroken chain of integrity all the way back to its manufacture. This means that ‘Good Delivery’ gold bars are accepted globally and easily traded on the wholesale bullion market.

Follow these simple steps to register now and start buying and selling gold from 1g to whole gold bars from anywhere in the world with BullionVault.

1. Open an account (only takes 1 minute)

You can do this via the website or downloading our Android or iPhone trading apps. Try out buying and selling with a free sample. You’ll get 4g of silver and cash to get started.

2. Transfer funds

Transfer funds from your bank account to your BullionVault account by making a manual bank transfer or where available using easy bank transfer that will initiate a transfer via your mobile banking app.

BullionVault only accepts US Dollars, Euros, British Pounds or Japanese Yen. For additional information, check our funding FAQs.

3. Buy your gold as part of a wholesale gold bar using the live order board (only takes 1 minute)

Choose the vault in which your gold is securely stored and insured.

4. Validate your account (only takes a few minutes)

We are obliged by law to verify the identity of our users, validation is a simple process that requires proof of your appearance, your address and your linked bank account. Read further about our validation process.

Sell Gold Bars 24/7

The live order board is available 24/7 on the website or via the Apps which means that you can sell an entire gold bar or smaller quantities at any time, even at weekends or when the wholesale markets are closed.

The benefit of the live order board is that you can accept the current prices being offered and sell your bullion immediately or you can set your own selling price and wait for a buyer or buyers to accept your price.

Sell your gold bars on our live order board

For additional information on how to sell your precious metals, visit our Sell gold, silver and platinum guide.

Here is a video guide of how to buy and sell gold bullion bars using our live order boards.

If you have a reserved bar or own more gold than in a 400-ounce (12.4kg) gold bar we recommend that you review the option sell at the Daily Price or alternatively contact us so that we can help you with a main market trade.

Gold Bars Delivered

At BullionVault, you can buy physical gold from as little as one gram at a time. Stored in bullion market-approved facilities specialising in handling gold bars, your gold retains its maximum resale value.

We enable you to store and insure your precious metals in the vault of your choice at wholesale market rates. And because you own your bullion outright you can take delivery of your gold bars at any time.

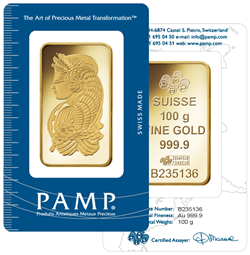

The easiest way to withdraw your gold, providing you own more than 100 grams, is in the form of a Pamp Fortuna 100g bar (limited to one 100g gold bar per delivery batch). This standard format with regular dispatch dates is efficient and simple, allowing us to keep costs low. The gold bar will be shipped to your registered address and must be signed for.

Contact us via live web chat or phone during office hours if you want to learn more from an actual human being.

Scroll to the page footer to speak to us from anywhere in the world via our green click to call button.

For more information please read our page that details all the ways to withdraw your gold bars.

Gold Bars FAQs

Buying gold in the wholesale bar form in the vault of your choice is an instant way to own physical gold and also avoids the cost and worry of having a gold bar shipped to your home.

Small gold bars can be purchased from retail stores, but often these prices are inflated above the wholesale market price to hide the cost of ‘free shipping’ and increase the retailers profit margin.

Similarly when you come to sell the price you are offered will likely be well below the wholesale market price.

See the live order board where you can see real-time prices to both buy and sell gold bars.

A 400-ounce (12.4kg) gold bar currently costs over $1m. However, the gold price is constantly moving so the easiest way to get the latest costs for any weight of gold is to use our cost calculator. You can use the cost calculator to compare our prices vs gold bars from other retailers.

Professional 400-ounce (12.4kg) "Good Delivery" gold bars are traded globally on the wholesale bullion market. This is where these large bars are the cheapest to buy and sell for the highest price.

The best place to buy gold is where you can easily gain access to these professional markets and benefit from the tight price spreads, low transactional costs and cheap storage and insurance. BullionVault was set-up to enable you to instantly access these wholesale markets and benefit from the tight spreads resulting in lower prices to buy and higher prices when you come to sell.

The large gold bars shown in movies and on TV are 400-ounce (12.4kg) "Good Delivery’ bars. These gold bars are traded around the world on the wholesale bullion market and are the cheapest way to buy gold.

All other smaller gold bars from 1g flakes to 100g minted bars all start out as a 400-ounce (12.4kg) gold bar before being smelted and cast or stamped into smaller bars, incurring more machining, energy and cost.